Tips to help Operations and Finance find common ground on asset management

In today’s manufacturing world, the impact of downtime is pretty clearly understood at the top of the food chain. But what about the benefits of uptime, preventive maintenance, or end-to-end connectivity? How do you, as a maintenance and reliability professional, make a case for long-term planning if there aren’t any concrete short-term financial gains?

Suzane Greeman, ASQ-CMQ/OE, CAMA, CMRP, and principal asset management advisor at Greeman Asset Management Solutions, Inc., discussed this challenge in a March 2020 webinar for Fluke Reliability, “Your CFO doesn’t like you: 6 Ways to align Operations with Finance.”

The difference between Finance and Operations isn’t personal, of course. In fact, according to Greeman, the perceived gap between the two organizations is mostly just a difference in language.

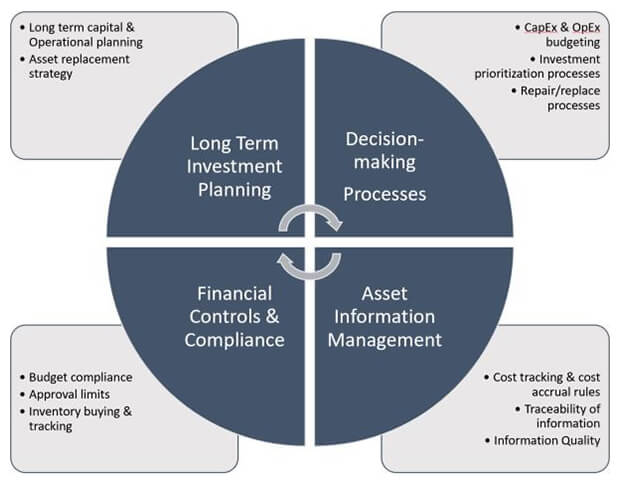

Look at the number of intersections between Finance and Operations, as depicted in Figure 1. Both departments care about the same thing: the health of the facility. They just use different terms and processes.

And of course, having a good relationship with Finance makes all the difference when it comes to funding skilled personnel and modernization projects.

Figure 1. Interactions and intersections between Operations and Finance

Figure 1. Interactions and intersections between Operations and Finance

To bridge the gap, Greeman advises learning some financial lingo so that you can communicate apples-to-apples and provide the operational information finance needs. Indeed, a memorable part of Greeman presentation is when she uses Kenny Rogers’ song, “The Gambler,” to explain what a chief financial officer needs from maintenance:

“Suzane, I have to fund your activities, and make sure bills are paid

Remember all risks are financial, so plan with that in mind

Inventory ties up cash flow and you like to buy parts”

“You got to know when to expense, know when to capitalize

Align your asset registry with the fixed register

You can’t retire your assets without telling us

I could claim more insurance and warranty if you only kept good records.”

According to Greeman, there are four ways maintenance teams can improve—or damage—their relationship with the finance department.

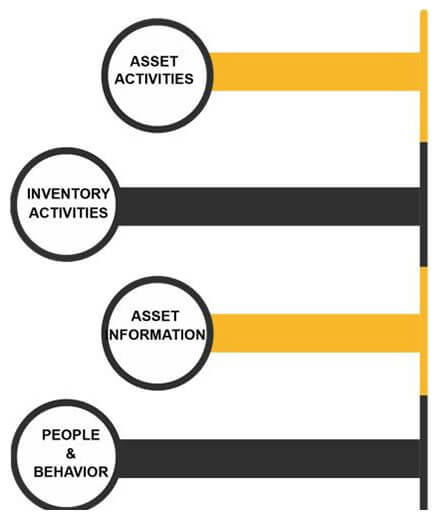

Figure 2. Operational stressors for Finance

Figure 2. Operational stressors for Finance

- Asset activities: This includes long-term investment planning and asset condition tracking.

- Inventory: Bloated inventory, lack of movement, stockouts, and supply chain disruptions are all stressful occurrences for Finance.

- Asset information: An accurate asset registry, up-to-date condition data, and integrated CMMS and ERP systems can all impact the bottom line.

- Transparency: Bypassing internal controls, budget guidelines, and reporting almost always backfires.

Greeman explains each of these “stressors” in greater length in her presentation. “Think about what you do, as Operations, that impacts Finance,” she says.

If nothing else, consider the tax implication of the assets a factory owns. Each of those assets depreciates over time and that depreciation affects the factory’s annual tax burden. And depreciation isn’t just measured in calendar age but in terms of asset health—the lifeblood of a reliability engineer.

Finance depends on Operations to report new asset capitalization activities (purchases and costs), asset depreciation information, and asset retirement updates, so that they don’t pay an inflated tax penalty. “The better your data picture of asset health is,” Greeman says, “the more confident your CFO will be.”

Asset management and asset health are common denominators between Finance and Operations, and information is the glue between the two groups. Finance regards “risk” in ways that are similar to an asset reliability risk assessment. You should learn the basics of asset valuation—for example, CapEx versus OpEx—and how they apply to asset management and what accountants are looking for.

Another commonality? Long-term thinking. Long-term investment planning is a key to an organization’s overall financial health. As Greeman says, “Assets have long service lives. Having a good asset management strategy is future-proofing the organization.”

To learn more finance terminology and to better understand the common ground between Finance and Operations, listen to the complete recorded presentation by Suzane Greeman online.